This Vision of a Digital Public Infrastructure to ease delivery of social welfare overcoming bottlenecks and distinctions is now available for governments to utilise, to know more click here.

Easing Pension delivery to the informal sector workers enabled on a Digital Public Infrastructure

Overview

Pensions comes under the domain of the Ministry of Personnel, Public Grievances & Pensions. For the purpose of this blog, we will review the scope of Pension schemes in India, with a focus on the Informal sector.

Some numbers for perspective – Central government pensions

Formal sector employment is a meagre ~3 cr in India and financial security for those outside the formal economy, especially once they are beyond the working age group is a big challenge. To provide for financial and social security, the government has initiated multiple schemes. Provision of universal social security is an important component of a well functioning society

For the informal sector, centrally directed pension scheme – Atal Pension Yojana (APY) exists which is primarily a central government & supervised scheme. The scheme is applicable to all Citizen of India, including those in the unorganised sector who do not have any formal pension provision. Beneficiaries can enroll at as low as INR 42/Month to avail this scheme leading to a pension of INR 1000/Mo at the age of 60. 3A & 3B

Under APY

- Number of enrollments under APY – 4.35 cr as of 30th July, 22 4

- Government disbursements – INR 57,078.22 lakh, till February 2021 5

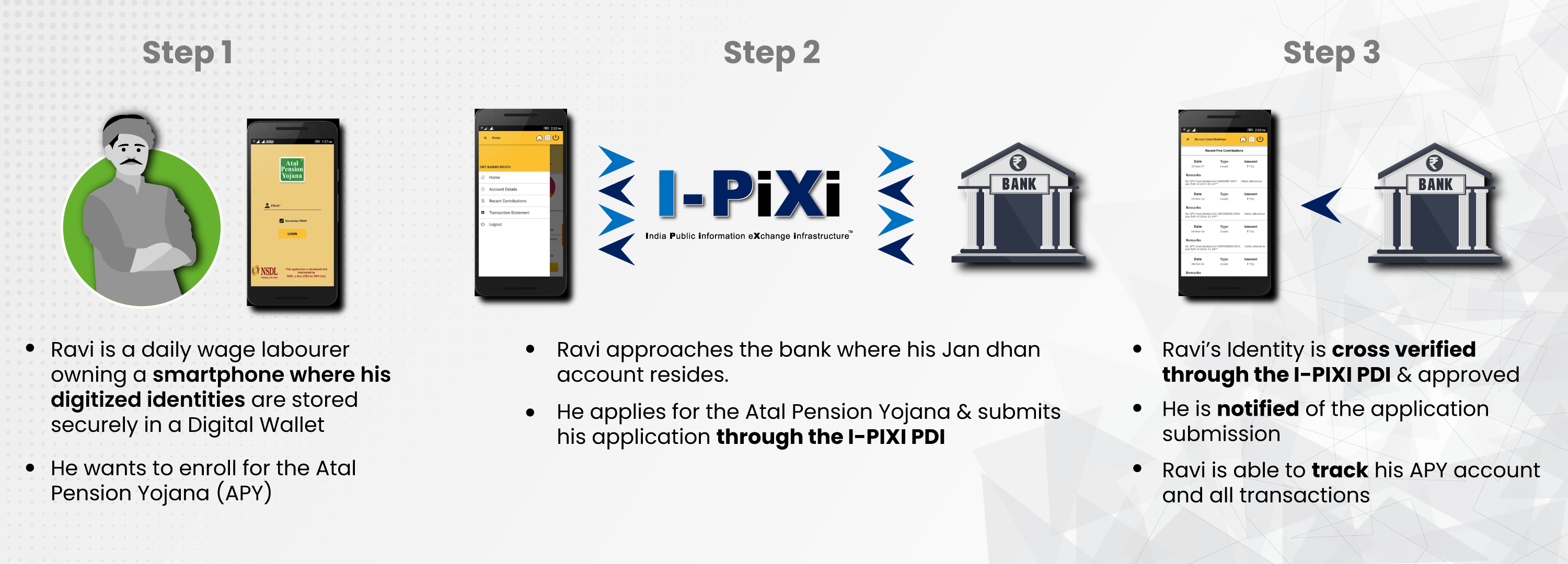

The process involved in applying for the scheme are outlined online mainly involving the authentication of Age, Name & Citizenship that can be availed from the beneficiary’s Aadhaar card. 6

In addition to the above, the specific Pension amount has to be mentioned and confirmation of the application submission

The government has further undertaken multiple initiatives to drive enrolment in this voluntary and contributory pension scheme by enabling enrolments through the APY app accessible from the UMANG platform. 7

Considering the centrality of the Aadhaar card in the lifecycle of a beneficiary’s APY account from enrolment to disbursement to death, we now have the technologies at hand to automate this entire process on a Digital Public Infrastructure leveraging a Public Blockchain.

Introducing a Digital Public Infrastructure (DPI) for seamless pension delivery based on a single source of truth on a Public Blockchain

Innovation in governance is critical to realize the vision of Driving Inclusive development & reaching the last mile overcoming bottlenecks of Geography, Language, Caste or Class.

This diagram depicts the vision of how I-PIXI as a Blockchain for governance can ease pension delivery to the citizens of India.

Logos / Images / Emblems used only for representational purpose for this application document– not for external circulation

Is the Digital Public Infrastructure comprising of Device providers, Application Developers, Government registries, Government departments, Technology infrastructure & Social sector organizations that will enable any citizen of India to avail any scheme that they are eligible for, based on a Public Blockchain

References

- Reference – as of 31st Mar’21 – https://pensionersportal.gov.in/dashboard/CGP/RPT_CGP.aspx

- Reference – https://www.business-standard.com/article/economy-policy/rs-2-54-trillion-spent-on-central-govt-pensioners-during-fy2021-22-122080301136_1.html

- Reference – https://financialservices.gov.in/sitesf

- Reference – https://pib.gov.in/Pressreleaseshare.aspx?PRID=1706615

- Reference – https://npscra.nsdl.co.in/nsdl/forms/APY_Subscriber_Registration_Form.pdf

- Reference – https://www.livemint.com/news/india/govt-list-out-steps-to-increase-the-enrolment-under-atal-pension-yojana-11616411944218.html